Mortgage rate lock fee calculator

Yes you can lock in a mortgage rate with more than one lender. You may be able to get an.

Why It S Super Important To Lock Your Mortgage Rate

Our simplified mortgage application will walk you through each step.

. Locking a rate can protect you from swings in the market. The average mortgage rates are as follows. Todays Mortgage Rates 30-Year Mortgage Rates 15-Year Mortgage Rates 51 Arm Mortgage Rates 71 Arm Mortgage Rates Lender Reviews Quicken Loans Mortgage Review.

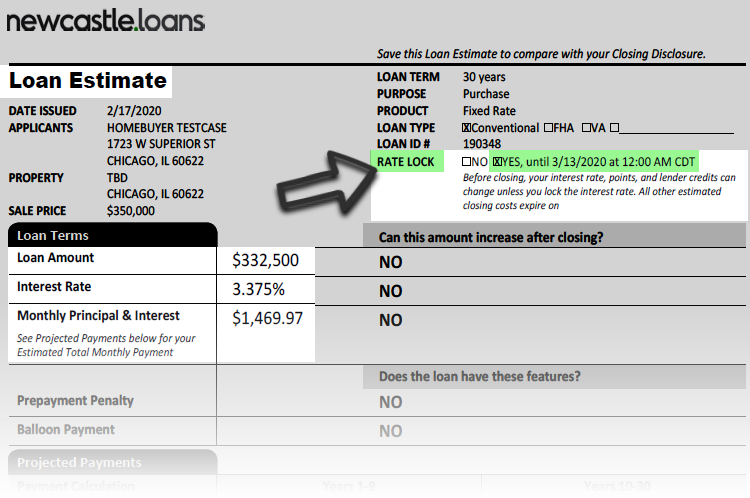

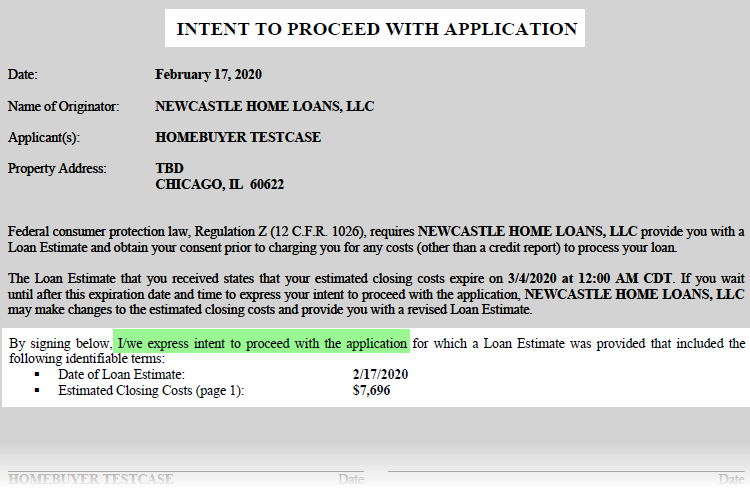

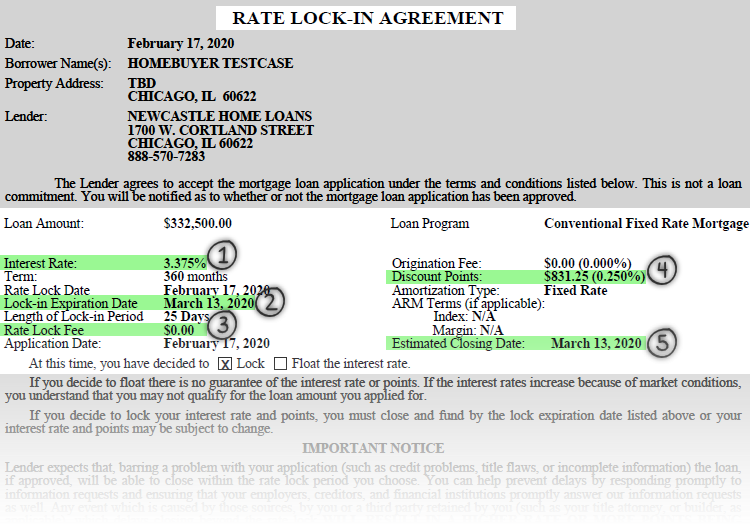

You request a mortgage rate lock extension. Top-Rated Mortgages for 2022. A mortgage rate lock is an agreement between a borrower and a lender that allows the borrower to keep a certain interest rate on a mortgage for a specified time period.

See the results for Mortgage lock in rate in Los Angeles. Some borrowers decide to lock a rate with Lender 1 and let their rate float with Lender 2. When mortgage rates tank out of the blue demand for refinancing and buying a new home increases.

Therefore your mortgage rate extension fee equals. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. If you plan to go to contract within three months of obtaining an Ark Certified Pre-Approval you can reduce the stress of the homebuying process by purchasing Rate.

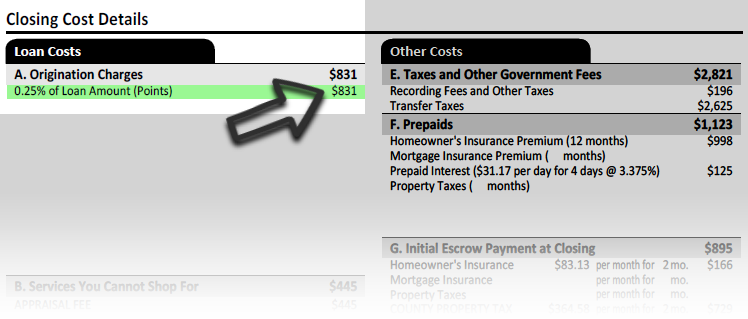

Todays average 30-year fixed mortgage. Generally refinance rates are locked for 30 60 days in a normal market. Due to the larger mortgage amount your bank charges a 017 percent fee.

So you might be charged 125 for a 7-day lock extension or 25 for a 15-day extension. That way if rates fall. 4 hours agoWe also saw an upward trend in the average rate of 51 adjustable-rate mortgages ARM.

Therefore your mortgage rate extension fee equals. Calculate Your Home Loan. When locking the interest rate on a mortgage the rate will be set for a specific period of time.

Lets assume that a borrower is currently applying for a 600000 home loan with a 3-year fixed-rate at an interest of 229. Get Started Talk to a. Rates are At a 40-year Low.

Given that ARM loans are variable the interest rate could end up being higher than with a 30-year fixed rate mortgage that has a locked-in mortgage rate. As a result rate. The length of this locked period will vary depending on the lender mortgage.

Ad Compare The Best Mortgage Rates. Only From Quicken Loans. Using our mortgage rate.

Ad Gain Peace Of Mind While You Shop For A New Home. Ad Work with One of Our Specialists to Save You More Money Today. Heres a general calculation of how Rate Lock works.

A mortgage rate lock is an agreement between you and your lender to temporarily lock your interest rate for a specific period of time typically 30 to 90 days. Apply Now Get prequalified Have us contact you to see how much you may be able to borrow. These fees will vary from lender to lender and could be more or less.

Lock in the Rate. You request a mortgage rate lock extension. Build Your Future With a Firm that has 85 Years of Investment Experience.

Ad Work with One of Our Specialists to Save You More Money Today.

Should You Pay To Extend A Mortgage Rate Lock Mybanktracker

How To Lock In A Low Mortgage Rate

Mortgage Rate Lock How And When To Lock In Your Mortgage Rate

Buyers Here S How To Decide Whether You Want A Mortgage Rate Lock

Should I Lock My Mortgage Rate Today And How To Do It Sofi

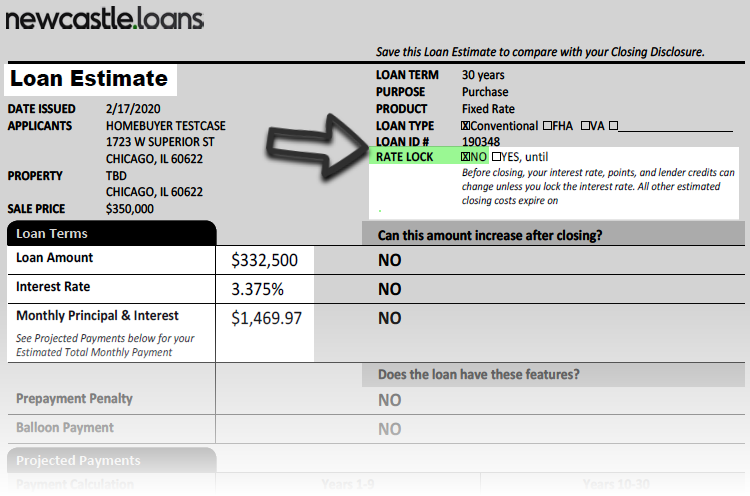

How To Read A Mortgage Loan Estimate Nextadvisor With Time

When To Lock In A Mortgage Rate Zillow

How To Lock In A Low Mortgage Rate

How To Lock In A Low Mortgage Rate

How To Protect Yourself From Losing A Rate Lock On A Mortgage

How To Lock In A Low Mortgage Rate

What Is A Loan Estimate How To Read And What To Look For

How To Lock In A Low Mortgage Rate

Mortgage Pricing Adjustments How To Read A Mortgage Rate Sheet

When Should You Lock Your Mortgage Rate Money

Why It S Super Important To Lock Your Mortgage Rate

How To Lock In A Low Mortgage Rate